Part A costs remain largely favorable for most enrollees. The program typically requires no premium for those with sufficient work history, but for those who do not qualify for premium-free Part A, monthly premiums will be $311 or $565 in 2026, depending on how long the individual or their spouse worked and paid Medicare taxes. This aligns with CMS’s framing that there is no single nationwide Part A premium aside from those who don’t meet the premium-free criteria, and it underscores the ongoing importance of work history in determining coverage costs. In practice, most beneficiaries still fall into the premium-free category, reflecting decades of payroll tax contributions.

For those facing Part A costs, the 2026 deductible for inpatient hospital care will be $1,736 per admission, up from 2025. Beneficiaries will also pay coinsurance for extended hospital stays: $434 per day for days 61–90 in a benefit period and $868 per day for lifetime reserve days. In skilled nursing facilities, coinsurance applies from day 21 onward, with the daily rate continuing through day 100 of extended care services, shaping a meaningful portion of out-of-pocket exposure for longer hospital or post-acute stays.

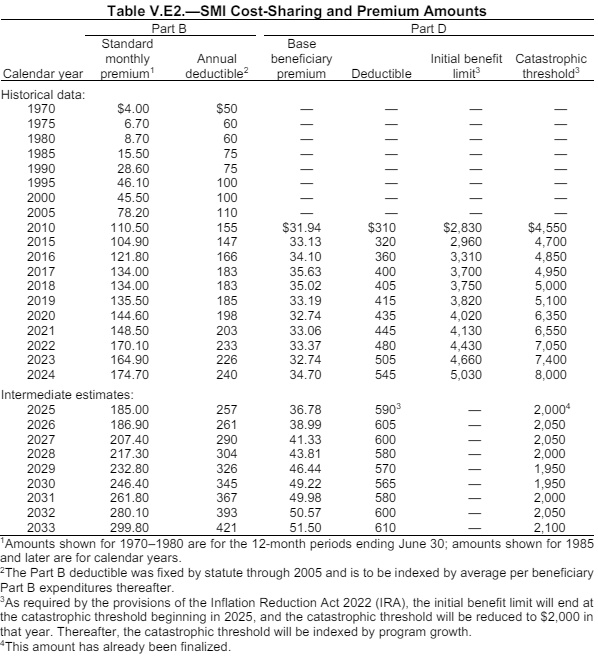

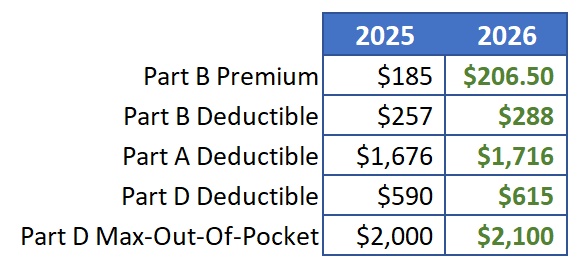

Part B costs, including standard premiums and deductibles, are also set for 2026, with the annual open enrollment window offering beneficiaries a chance to review and adjust coverage. While the standard Part B premium level is determined by CMS, a growing portion of beneficiaries may face income-related adjustments. A separate, income-based adjustment program—IRMAA—remains a key factor for higher earners, affecting Part B and, in some cases, Part D costs for Medicare beneficiaries enrolled in drug coverage. Projections circulating in the industry show a five-bracket IRMAA structure, with surcharges scaling by income. These brackets top out at higher thresholds, and the surcharges rely on tax data from two years prior, meaning 2026 IRMAA decisions reference 2024 tax returns.

Specifics on IRMAA brackets emphasize the threshold design: the five brackets and associated surcharges are calculated based on household income, with the highest brackets affecting those with substantial earnings. The two-year lag means a taxpayer’s 2024 income figure determines 2026 IRMAA implications, a feature that has prompted many to check 2024 tax outcomes to gauge potential surcharges. In addition, IRMAA applies not only to Part B but also to Part D for beneficiaries with a Medicare Advantage plan that includes prescription drug coverage, reinforcing how high earners may see a layered increase in costs beyond base premiums.

Beyond premium and deductible announcements, open enrollment—running from October 15 through December 7—advances as a critical period for beneficiaries to compare plans. Industry observers highlight that 2026 could bring a mix of premium movements: some plans will see small upticks, others minor declines, and overall changes in coverage or out-of-pocket costs. The message from experts is clear: review multiple plans to find the option that best fits anticipated care needs, especially as changes could affect out-of-pocket exposure for hospital care, physician services, and drugs.

The guidance is consistent with Medicare’s broader framing: costs vary by coverage level, services, and providers, with no annual out-of-pocket limit in Original Medicare unless a beneficiary has supplemental coverage such as Medigap or a Medicare Advantage plan with an out-of-pocket cap. As the year progresses, beneficiaries are urged to evaluate plans carefully, recognizing that 2026 costs will hinge on deductible levels, coinsurance, and the IRMAA framework that could apply to higher-income households.